The Dollar Is Breaking. Is the World’s Biggest Player Quietly Rethinking Bitcoin?

Actionable Market Insights

We’re pleased to announce that we are an official partner of Consensus Miami, taking place May 7–9, 2026. Attendees can use our exclusive discount code to receive 20% off tickets. ($170 off)

Secure your ticket (here) using the link below before Consensus raises prices.

The Dollar Is Breaking. Is the World’s Biggest Player Quietly Rethinking Bitcoin?

Why this report matters

The U.S. dollar has broken a critical decade-long support level, while U.S. debt continues to accelerate, developments that should already be ringing alarm bells for foreign investors. Compounding this, Trump’s renewed tariff threats are now facing increasingly visible pushback from the international community, further accelerating the shift away from dollar exposure.

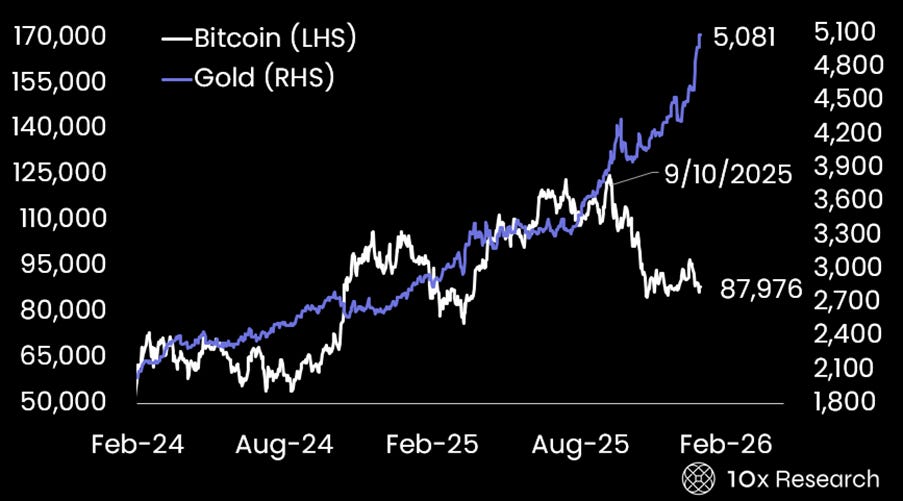

Precious metals have been the primary beneficiaries of this diversification so far. Key technical levels have once again been breached, levels that have historically led to sustained follow-through, suggesting that the trend away from the U.S. dollar is not yet exhausted.

Yet a larger story is quietly developing in the background. While Bitcoin’s technical structure remains weak for now, the macro forces taking shape could carry far-reaching implications once a catalyst emerges. When that spark is finally triggered, the repricing may not be gradual. It is not a trade for today given Bitcoin’s still-weak technical structure, but the underlying rhetoric is quietly shifting.

Bitcoin (LHS) vs. Gold (RHS)