The Key Catalysts Pointing to a Bitcoin Breakout

Actionable Market Insights

Why This Report Matters

Bitcoin is poised to break above $106,000. But this isn’t just about technicals—several powerful catalysts are aligning. We also dive into our liquidity model and project how long this Bitcoin rally might last, based on a leading relationship. This report reveals the next target and guides how to trade it. On Monday, we spotted the large divergence between Bitcoin and Coinbase (here) with the shares now +28% in just two trading days. Our DogeCoin trading signal has returned a 25% gain since May 8 (here).

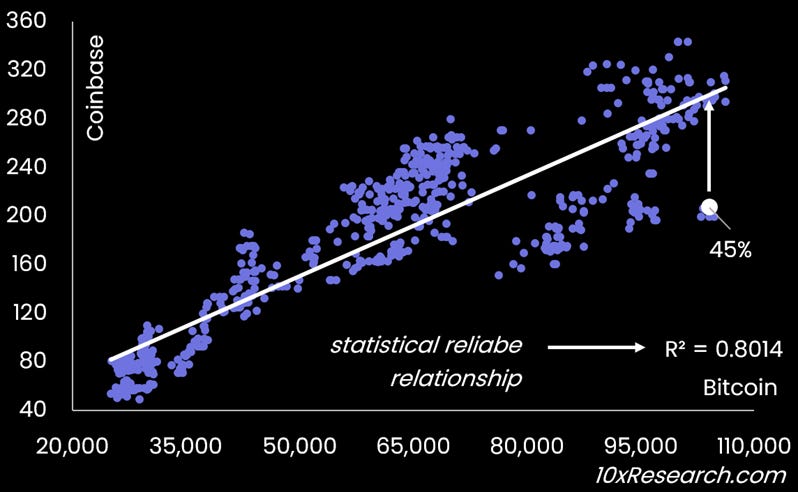

Coinbase had +45% upside based on our Monday analysis (only +15% left)

10x Research was established with a hedge fund-style investment approach, where data, narratives, and news are continuously re-evaluated, catalysts are identified, and actionable trading insights are generated. Given our commitment to this disciplined and methodical process, we decided to extend it to a select group of like-minded investors and traders (our subscribers), ensuring we maintain rigor even during quieter market periods.

Koreans are jumping on XRP, as we expected (here)

This discipline is essential, as it helps us stay alert to shifting opportunities by identifying catalysts and leveraging quantitative models to detect market changes. While systematic trading in crypto can be challenging due to the active management of tokens by foundations, our approach ensures we are immediately notified when a series of buy (trading) signals is triggered.

The value of 10x Research extends beyond our extensive background managing large portfolios for JP Morgan, Millennium, and other leading hedge funds. Our team has overseen hedge fund capital across both crypto and traditional finance (TradeFi), and readers of our analysis benefit directly, saving them significant time. Our sophisticated data analysis approach is built on the expertise we developed while working in the hedge fund group at Goldman Sachs, enabling us to swiftly identify market opportunities, assess risks, and deliver actionable insights with precision.

Let’s dive into today’s report:

Key Takeaways

Core View: Bitcoin is poised for a breakout above $106,000, targeting $122,000.

Key Driver: Multiple catalysts, including crypto IPOs, FTX payouts, and MicroStrategy’s accumulation.

Major Risk: Rising bond yields and potential shifts in Federal Reserve policy.

Recommended Trade: Long Bitcoin with a target of $122,000, or call spreads on Ethereum to capture volatility.

Main Argument

Macro View

The upcoming IPO wave of crypto companies could add $100 billion in market capitalization.

FTX’s second wave of creditor payouts ($7-11 billion) could inject fresh liquidity.

Rumors of an Ethereum-focused strategy, similar to MicroStrategy’s, are gaining traction.

MicroStrategy’s (and others) continued Bitcoin accumulation creates buying pressure.

Technical View

Bitcoin is approaching the critical $106,000 resistance level, with $122,000 as the next target.

Low implied volatility (42%) makes call options attractive for upside exposure.

Ethereum call spread could capture upside toward $3,000.

Risk View

Rising bond yields could dampen speculative sentiment in crypto.

The Federal Reserve’s policy direction remains uncertain, posing macro risks.

Main Text

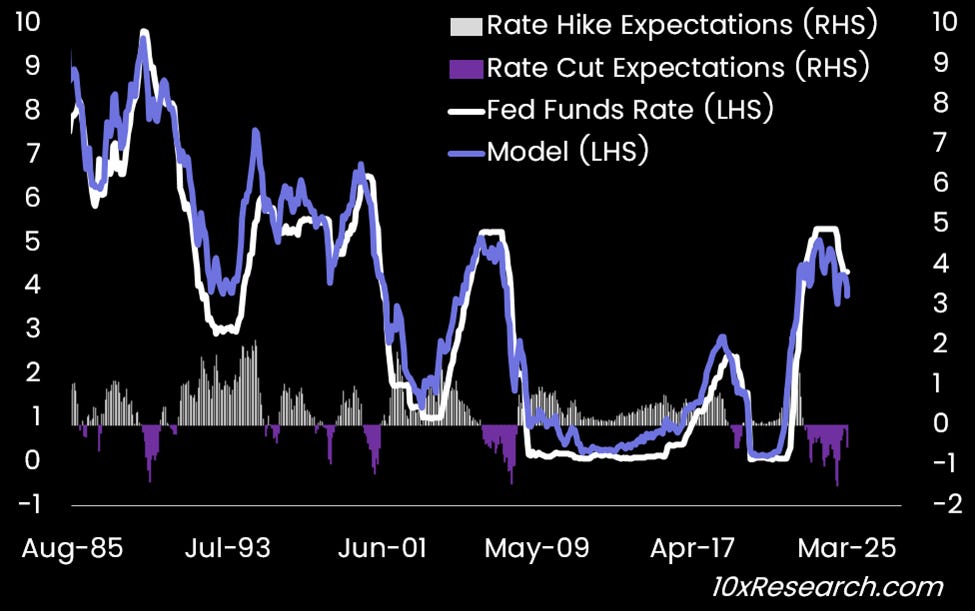

While we continue to expect the Federal Reserve to begin cutting interest rates from September onward, the feared inflation spike may not materialize. Instead, a decline in oil prices—identified in our March 28 report as an “overlooked bullish catalyst for Bitcoin”—could trigger lower inflation. At the same time, the threat of tariffs may weigh on consumer spending, potentially leading to a deflationary environment rather than rising prices. The Fed may eventually pivot to a more dovish stance. Markets could react sooner, preemptively pricing in a dovish narrative.

US rate cuts are priced in, but (bullish) growth expectations could reverse

However, if inflation concerns shift from tariffs to fears of stronger-than-expected growth, the potential extension of Trump-era tax cuts could spark renewed bullish sentiment. Notably, the two-year bond yield has already risen from 3.60% to 4.00%, reflecting reduced recession fears and pricing in upside growth expectations, reducing the potential for rate cuts. With the upcoming Q2 earnings season in mid-July, the strength in tech spending confirmed during Q1 has already fueled a bullish outlook.

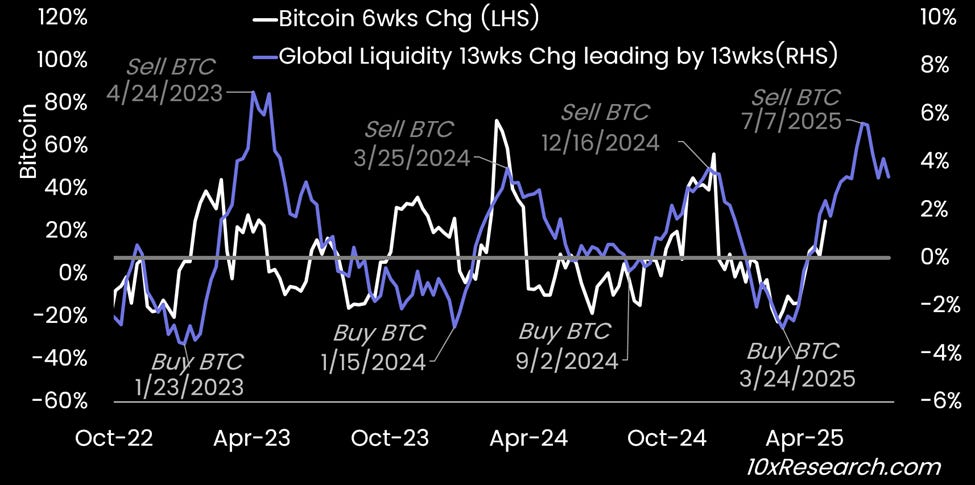

Mid-July is not only the start of the Q2 earnings season but also the expiration of the 90-day tariff deadline—an event that many may have forgotten by then. This timing also coincides with the global liquidity indicator reaching its expected peak. Unlike the widely followed liquidity metric, which many mistakenly believe works due to a 13-week lag— a pattern that has only held sporadically over the last decade — our preferred ‘market structure’ model uses real market liquidity measures.

Bitcoin follows Global Liquidity with a 13-weeks lag, peak July

Although social media personalities may continue to hype the lagging ‘Global Liquidity’ metric, creating a self-fulfilling effect, we prefer our version, which offers a more accurate time window for liquidity peaking. Given that the Global Liquidity metric uses a six-week rate of change, it currently projects substantial upside until that peak is reached.

But there are even more catalysts on the horizon. A second wave of FTX creditor payouts, expected between $7-11 billion by May 30, is significantly larger than the first round, which passed with little market impact. We also estimate that around $100 billion worth of crypto companies are preparing for IPOs in late 2025 and early 2026—a number that could rise even higher.

These companies, along with their investors and Wall Street banks, have a vested interest in maintaining strong Bitcoin prices, especially after missing the chance to cash out during the last cycle when the SPAC window closed. MicroStrategy continues to accumulate Bitcoin, capitalizing on favorable market conditions as long as its share price remains above its net asset value (NAV). At the same time, rumors suggest that an Ethereum-focused strategy, similar to MicroStrategy's, could soon emerge from another player, further boosting bullish sentiment.

This IPO wave is also driving an M&A boom, with Animoca Brands potentially valued at $10 billion, Ripple expanding through billion-dollar acquisitions, and Coinbase making a $2.9 billion purchase of Deribit. Robinhood is also expanding its presence in the cryptocurrency market. Just this week, we highlighted the growing divergence between Bitcoin and Coinbase. Within 18 hours, Coinbase was announced as a new member of the S&P 500—its shares are now up 28%. Meanwhile, Ripple’s XRP is up +13% after we correctly anticipated a Korean retail-driven pump on April 28.

Bitcoin moving in $16,000 increments, after $106,000 it should be $122,000

Bitcoin is on the verge of breaking above the critical $106,000 level, with $122,000 emerging as the next target in the coming weeks. Bitcoin has been moving in increments of $16,000, and several catalysts are driving this upward momentum. Despite being slightly overbought in the short term, Bitcoin’s implied volatility remains exceptionally low at 42%, suggesting that traders are not aggressively leveraging long positions. This low volatility environment makes call options an attractive way to gain upside exposure.

Actionable Idea

Long Bitcoin outright or with call options targeting $122,000.

For Ethereum, consider a call spread, targeting $3,000 while limiting downside.

Monitor IPO news and FTX payout developments as near-term catalysts.

Market Snapshot

Bitcoin Spot Price: $104,106

Ethereum Spot Price: $2,640

Implied Volatility: 42%

RSI (Bitcoin): 64

Stablecoin Issuance: $150 billion Tether Market Cap

Time Horizon

6-10 weeks, with potential extensions depending on IPO timelines.

What Could Change Our View

A sharp rise in bond yields above 4.5%, dampening risk appetite.

A hawkish shift from the Federal Reserve, delaying rate cuts.

Conclusion

Bitcoin is on the cusp of a breakout, driven by powerful catalysts like crypto IPOs, FTX payouts, and MicroStrategy’s ongoing accumulation. With $106,000 in sight, our focus remains on seizing this opportunity while managing risk. Ethereum’s potential breakout above $2,600 also presents a compelling trade which is best structured with call spreads as we pointed out. And with more catalysts approaching the Bitcoin and altcoin rally might have legs. If July is indeed the peak, then crypto markets might have another two months of bull run.