The Macro Trap: Why Bitcoin Isn’t Reacting as Expected

Actionable Market Insights

Why this report matters

Bitcoin is once again trading at the intersection of Fed policy, U.S. dollar dynamics, and a liquidity narrative that looks far less straightforward than most investors assume. While rate-cut odds for December have jumped to 84%, history shows it’s not the cut that matters, it’s the message that comes with it. At the same time, a rarely triggered U.S. dollar signal has just flashed for only the fifth time in Bitcoin’s history, and its past outcomes weren’t exactly comforting. Many are pointing to a potential $600+ billion liquidity release from the Treasury’s cash account, but the last time this happened, Bitcoin still fell hard before reacting much later. Below we break down what is means for Bitcoin.

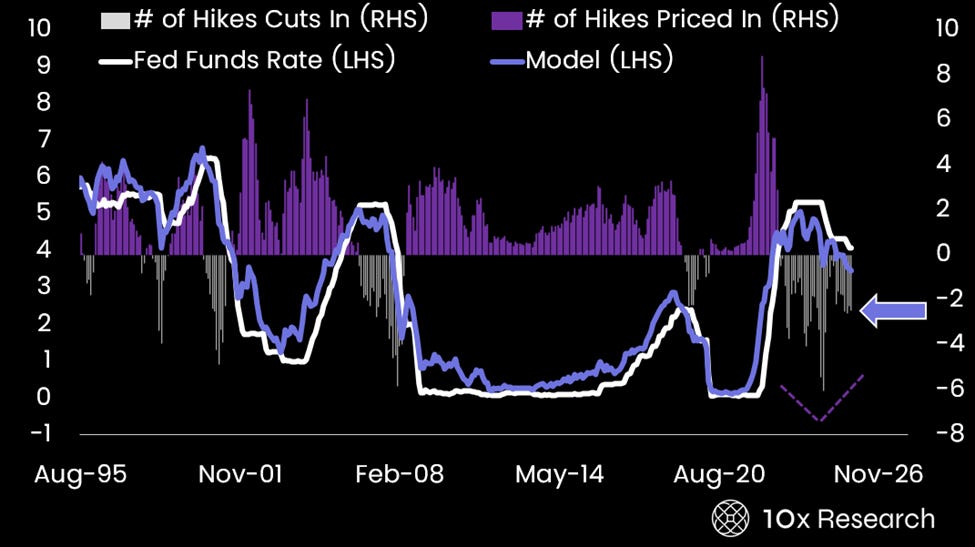

U.S. Fed Funds rate (LHS) vs. number of rate changed priced in (RHS)

Main argument

After several Fed governors signaled support for a rate cut on December 10, bond futures markets have now pushed the implied probability of a cut to 84%, while assigning a 65% probability that the Fed will remain on hold in January. However, as we saw on October 29, the more important variable is not the rate cut itself, but the forward guidance accompanying it. The Fed could again deliver a cut without providing genuinely dovish forward guidance, especially if this becomes a third consecutive rate cut, which would significantly dilute its supportive impact on risk assets. Let’s dive in deeper what it means for Bitcoin.