The ONE Bitcoin Trading Rule That Separates Winners from Losers

Actionable Market Insights

Why this report matters

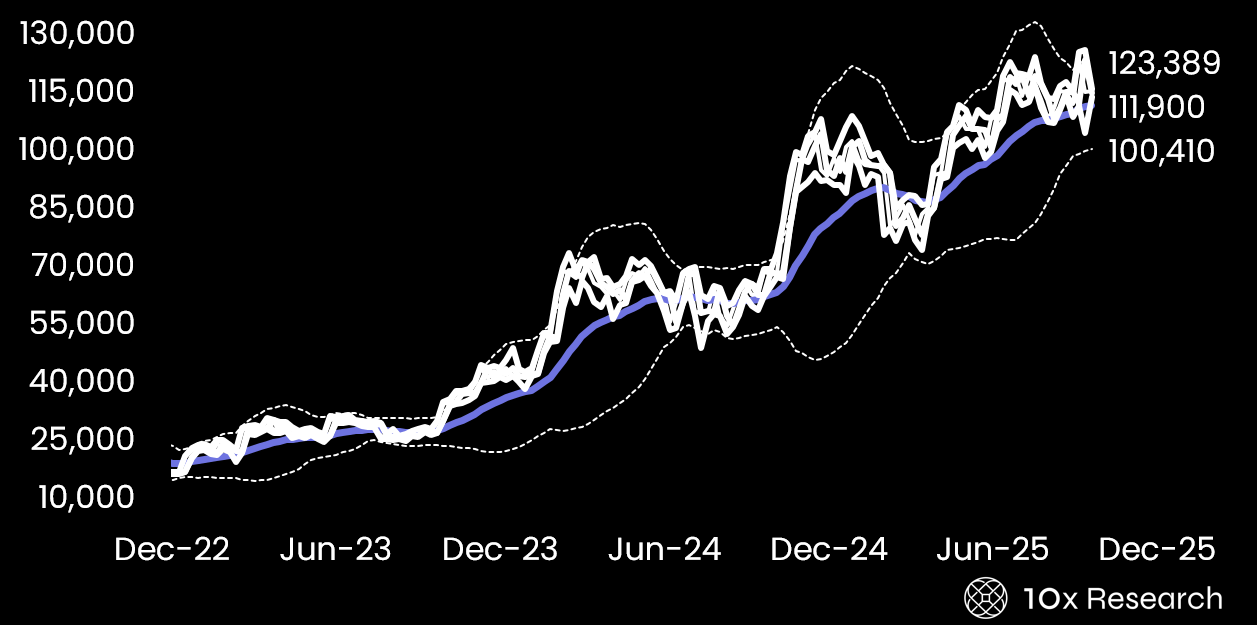

Volatility has returned with a vengeance, and traders are struggling to distinguish between noise and opportunity. Bitcoin is hovering between two critical “risk-off” levels, while the altcoin landscape is reshaping faster than most realize. Beneath the surface, funding rates, positioning resets, and volatility premiums are quietly creating asymmetric setups that few are watching. Retail narratives won’t drive the next move—but by structural capital flows and the way TradFi now trades crypto.

Bitcoin

We’re already seeing signs of which assets are regaining strength and which are fading for good. Rather than taking a broad-based “buy the dip” approach, we continue to advocate caution — focusing on selective, tactical (short-term) trading and some strategic (long-term) positions while maintaining a clear eye on key support zones that define the next directional move.

Amid all the noise and uncertainty, one simple Bitcoin trading rule has always separated winners from losers — and as we approach those key levels again, the market is about to reveal which side you’re on.