The One Chart Explaining Why Altcoins Still Aren’t Moving

Actionable Market Insights

Why This Report Matters

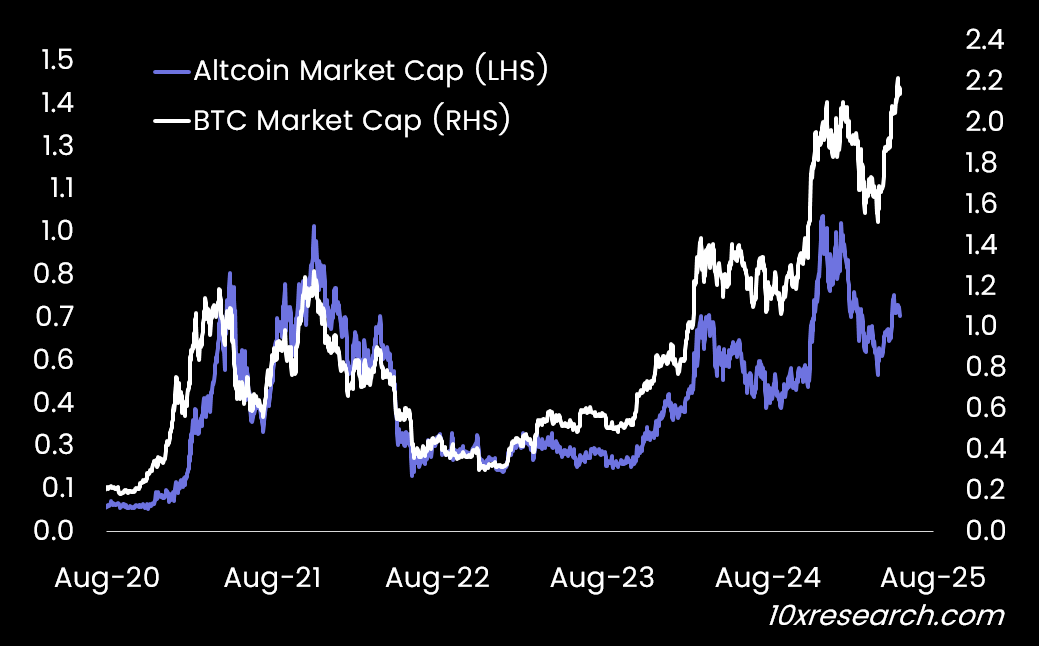

Altcoin bulls were promised fireworks—what crypto Twitter once called the "banana zone"—but reality has delivered a slow grind. Despite Bitcoin reaching new all-time highs and attracting deep-pocketed institutions, altcoins are stuck in neutral, weighed down by relentless unlocks and a narrative void. The old playbook of hype and leverage isn’t working in a world of 4.5% bond yields.

Even Ethereum, once the heart of crypto innovation, has settled into staking for a modest yield. So what’s really holding altcoins back this cycle—and who, if anyone, is still buying? The answers reveal a very different market structure than many expected.

Altcoin Market Cap (LHS) vs. Bitcoin Market Cap (RHS) - both trillion USD

Main Argument

It doesn’t take much to trigger altcoin pumps; a few well-placed buy orders can easily overwhelm low liquidity. However, sustaining those rallies is a different story. That requires broader participation from retail investors, and that’s where the real challenge lies. For over a year, crypto Twitter has repeatedly promised an explosive altcoin season, what some dubbed the “banana zone.” But that narrative has yet to materialize. Despite the hype, we still aren’t seeing the key ingredients needed to support such a rally.