The Polymarket Bitcoin Trade Paying 63% Annualized With Near-Certain Odds

Actionable Market Insights

Only 3 days left for Early-Bird Deal: Consensus Hong Kong Tickets for $479 (Save $500!)

This year, we had the pleasure of hosting several successful 10x Research community events and investor meetings across Hong Kong, Dubai, London, and Singapore. We’re excited to announce that this lineup will return in 2026 — with the possibility of adding one or two new cities.

The first stop will be in Hong Kong during the Consensus Conferences (February 10–12, 2026). We’re pleased to offer our community an exclusive 20% discount code — meaning that instead of $1,099, early bird buyers can secure tickets for just $479 (a $500 saving).

We’ll also be hosting another 10x Research side event during that week. You can secure your conference ticket below. Questions: info@10xresearch.com

Hong Kong Consensus Tickets HERE

The Polymarket Bitcoin Trade Paying 63% Annualized With Near-Certain Odds

Why this report matters

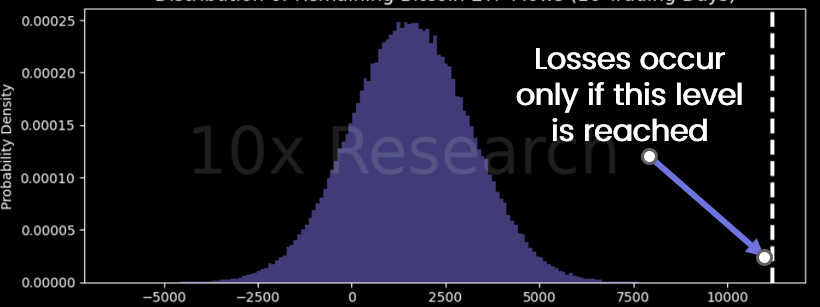

Bitcoin has remained pinned near $90,000 since November 18, validating our short-strangle positioning. On November 24, we recommended selling the $70,000 put and $100,000 call for the December 26, 2025 expiry, targeting roughly a 30% annualized return. With the structure now compressing from $2,279 to $1,435, the short-volatility thesis is unfolding as expected.

As liquidity thins into year-end, near-riskless arbitrage has become harder to find. Yet we outline below a compelling setup on Polymarket that still pays 63% annualized if the event simply fails to materialize, an outcome now approaching mathematical certainty (although it is more of a fun trade). More importantly, Wednesday’s FOMC echoes two earlier playbooks with clear outcomes for Bitcoin. Is this really the moment to gamble, or the moment to recognize the odds are already priced in?

Would you take this Bitcoin bet?