The Q4 Bitcoin Twist No One Sees Coming?

Actionable Market Insights

Why this report matters

Bitcoin’s seasonal strength in Q4 is one of the market’s best-known patterns—but what happens when everyone expects it? This year, traders are positioned for another October rally, yet the usual catalysts appear to be missing. Key technical levels are converging, and the next decisive move could be as large as $20,000 in either direction. Options markets are flashing warning signals, with traders leaning heavily against a breakout. Meanwhile, on-chain indicators are hinting at stress points that have historically marked turning points. The setup suggests that the biggest surprise of Q4 may not be what most investors are betting on.

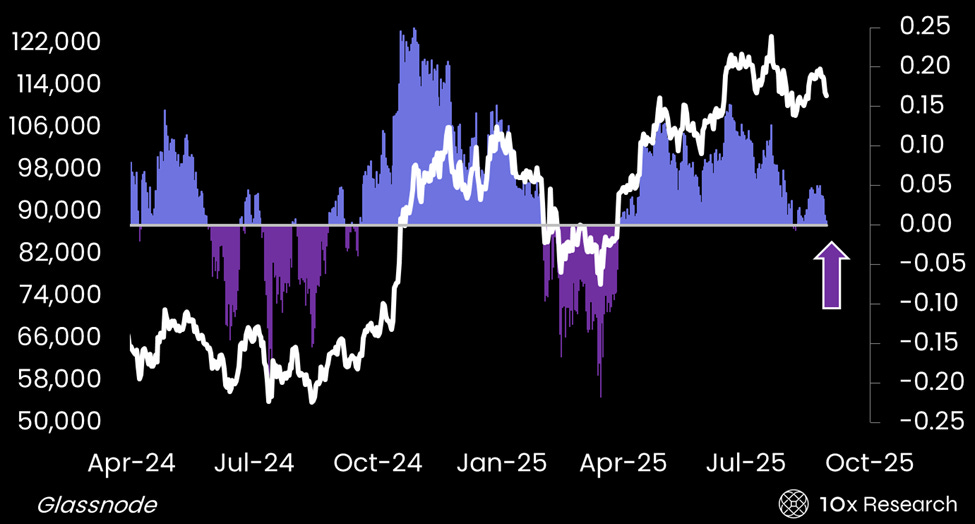

Bitcoin (LHS) vs. (explained below) - buy or sell here?

Main argument

By now, most traders are well aware of Bitcoin’s strong seasonal track record in October and Q4. We made major bullish calls in each of the past three Octobers: 2022 (here), 2023 (here), and 2024 (here). At least the first two were firmly non-consensus. Even last year, despite significant pushback, Bitcoin ultimately rallied from $65,000 to $100,000. Is Another Q4 Bitcoin Rally Really a Sure Thing?