This Q4, Bitcoin traders must be sharper—just staying leveraged long won’t cut it.

Actionable Market Insights

Why this report matters

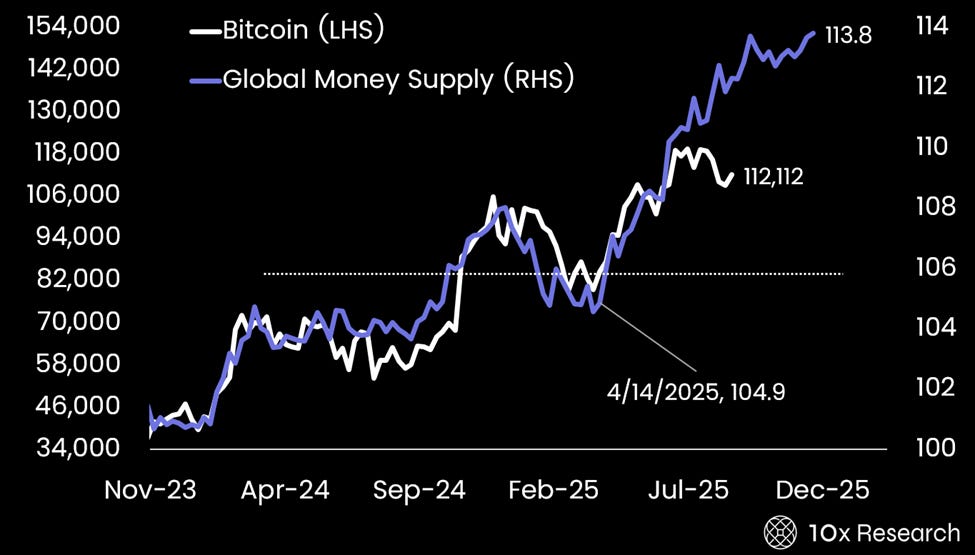

Some argue the macro backdrop is bullish with global money supply edging higher—but as we’ve highlighted before, that’s the wrong metric to focus on.

Bitcoin (LHS) vs. Global Money Supply (RHS) - predictability broken?

Other macro variables matter far more, and this year’s Q4 strategy is likely to play out differently than in the past three years. In October 2022, we correctly called the end of the Bitcoin bear market, pointing to Grayscale’s GBTC discount as a way to buy Bitcoin effectively below $10,000, and we also highlighted Solana bottoming at $13.90. By September 2023, we flagged Bitcoin miners as the ultimate Q4 bet, and in October 2024, we doubled down on our bullish stance as MicroStrategy broke above $177.

Each of those Q4 calls went against consensus—and proved right. Now, with the average analyst target sitting at an unrealistic $192,000 year-end target, consensus is far too bullish. By now, most know Bitcoin’s tendency to shine in Q4—but the game has changed. It’s no longer about simply staying long; today, smart trade structuring is the key to staying profitable. Still, there are opportunities to capture profits in Q4—just not in the way most expect.