Trading the Reset: Bitcoin’s Path Through the 2026 Cycle Low

Actionable Market Insights

Why this report matters

While our near-term stance remains bearish, the coming year will present a compelling buying opportunity ahead of a larger upside move into late 2026, 2027, and 2028. We approach this view with realism, based on our analysis, rather than wishful thinking. In the near term, multiple headwinds remain, encompassing technical signals, market structure, capital flows, and on-chain data. However, these dynamics are likely to be resolved over the course of next year.

Below, we outline a roadmap that identifies potential downside targets, the timing (tradeable tactical peaks & bottoms), drivers of short-term cyclical rallies, and how to trade those moves. In the early stages, the environment is likely to remain a trader’s market, as it has been for several months, with tight risk management required following the late-October regime shift.

While this trading-oriented phase should persist initially, we expect the market to ultimately form a bottom earlier than traditional cycle analysis would suggest, setting the stage for the next major advance.

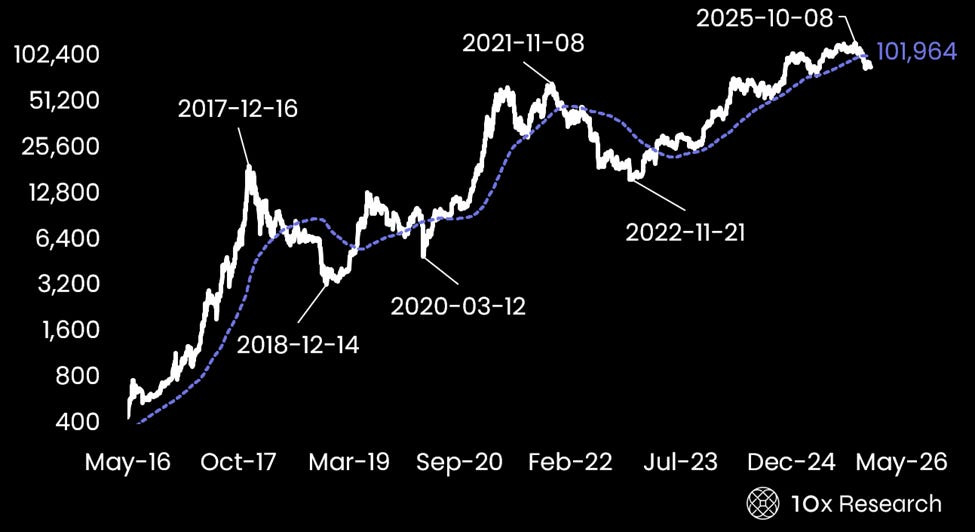

When we identified the cycle low in late October 2022, the prevailing sentiment was one of capitulation; most participants were dismissive and had effectively given up. We expect a similar backdrop when the next bottom is established ahead of the 2026 inflection point, just before a new 2–3 year bull market begins.

Bitcoin peaks vs. its 1-year moving average