Trump, Tariffs, and $100K Bitcoin: What Smart Money Is Betting on Now

Actionable Market Insights

Why this report matters

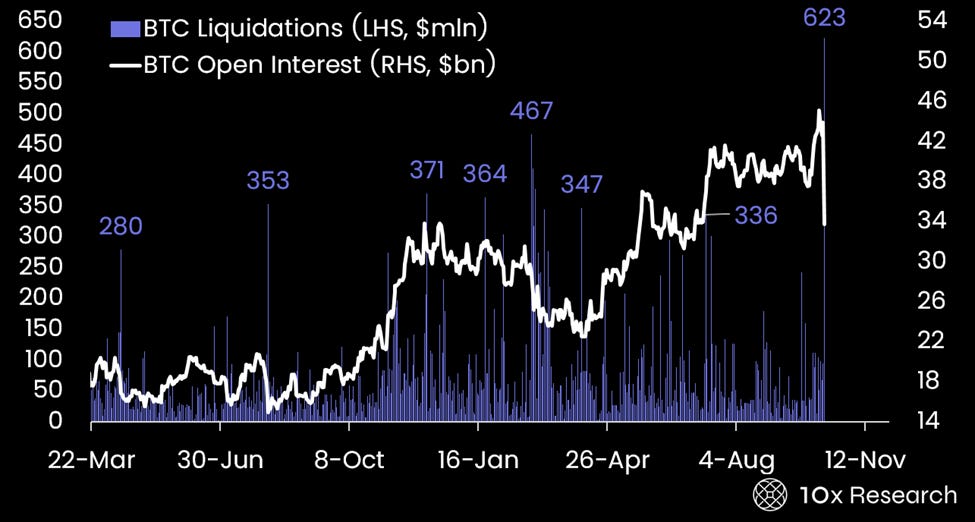

Markets are reeling after Trump’s surprise China tariff deadline reignited volatility, driving Bitcoin toward $100,000 and triggering one of the largest liquidation events in crypto history. With $8 billion in forced liquidations, altcoins collapsing multiple times more than BTC, and funding rates turning deeply negative, the setup is both chaotic—and full of opportunity.

Bitcoin dominance above 60% signals a new structural phase, while short-dated volatility above 50% opens the door for some of the most attractive option trades in months. Yet beneath the headlines, a bigger macro story is unfolding—oil below $60, Treasury yields breaking lower, and the S&P 500 showing its first technical cracks since spring. Will Trump’s next tweet spark relief—or fuel another selloff?

Bitcoin liquidations (LHS, $ millions) vs. Bitcoin Open Interest (RHS, $ billions)