Update: Bear Market Watch: What Smart Money Is Seeing in Bitcoin’s Data

Actionable Market Insights

Why this report matters

On October 22, 2025, in our report “Bear Market Watch: What Smart Money Is Seeing in Bitcoin’s Data,” we walked through the very same on-chain and macro indicators seasoned crypto investors rely on, signals that have repeatedly proven themselves across cycles. We ended that note with a clear stance: “an initial move toward $100,000 still remains our base case.”

That wasn’t a casual line. In the past three Octobers—2022, 2023, and 2024—we correctly called for major year-end rallies, including the now well-known contrarian call in 2022. But this time we highlighted something different: Q4 has historically been Bitcoin’s best season, yet the catalysts that typically fuel the move were notably absent. And by late September, on-chain metrics had already shifted from green to a warning-yellow, just as enthusiasm peaked elsewhere.

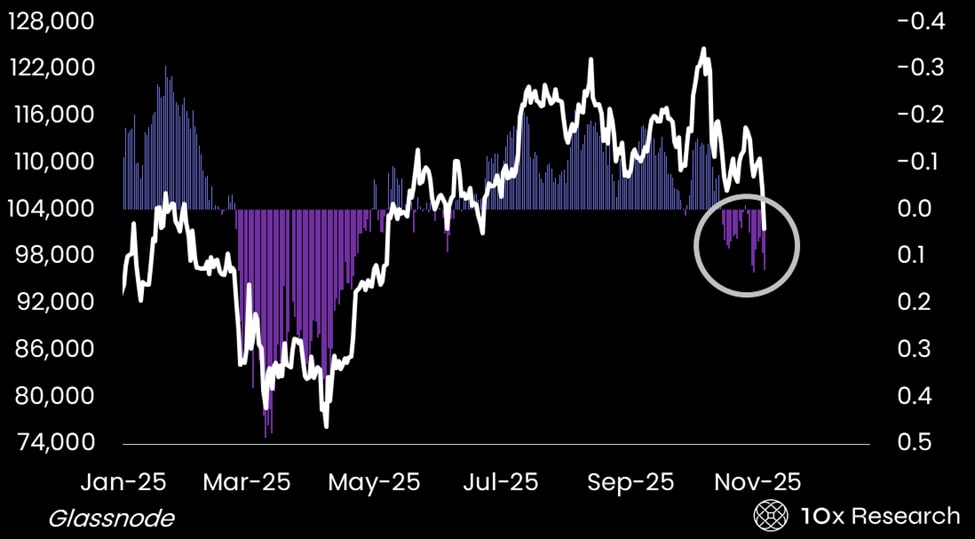

Bitcoin (LHS) vs. one of our key indicators (RHS)

Main argument

Many are now asking whether this is the dip to buy. Bitcoin has indeed pulled back to the key $100,000 level, and round numbers often act as psychological support zones. But price alone does not make a bottom. Before declaring this a buying opportunity, we are running a full check across our models, on-chain indicators, flow data, and macro signals to determine whether this pullback is healthy, or whether patience will be rewarded. In markets, those who sell early and buy back later consistently outperform those who simply “hope and hold.” Below is our updated Bear Market Watch analysis to separate signal from noise.