Wall Street Investors Wiped Out in Second-Largest Bitcoin Liquidation Since ETF Launch

Actionable Market Insights

Why this report matters

Something unusual is happening beneath the surface of this sell-off. The flows, the wallets, and the timing are telling a very different story than the headlines on OG investors that many brushed off as healthy. What looks like another routine pullback may actually be a structural unwind of positioning built over the past year. Meanwhile, liquidity is thinning in precisely the zones that matter most, just as institutional flows begin to show stress. A few on-chain shifts that only occur during regime changes have now appeared again.

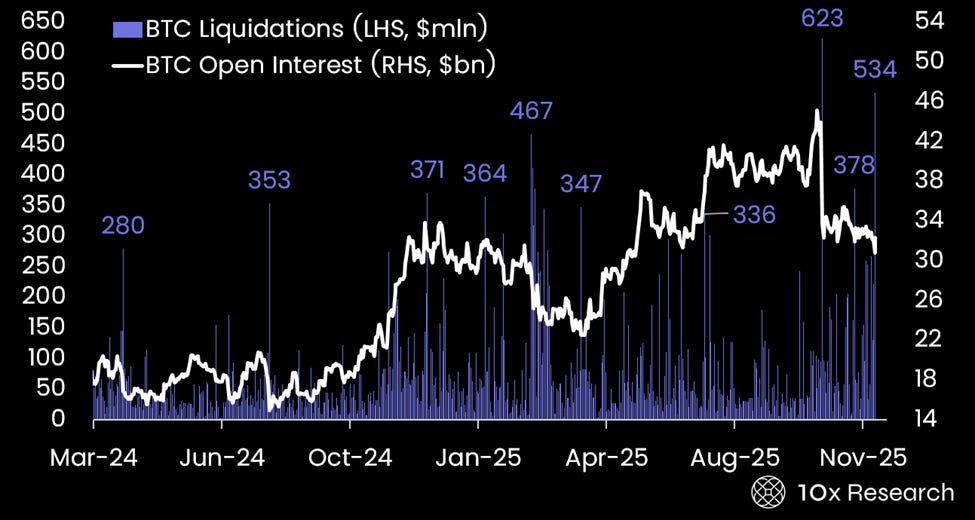

BTC Liquidations (LHS, $ millions) vs. BTC Open Interest (RHS, $ billions)

Main argument

Since Trump attended the Bitcoin Nashville conference in July 2024, including several closed-door meetings, something notable began to unfold on-chain. Wallets holding 100–1,000 BTC began aggressively accumulating, becoming the fastest-growing cohort. Their combined holdings increased from 3.9 million BTC to 5.17 million BTC, largely through purchases from mega-whales (those holding 1,000–10,000 BTC), including many legacy holders, miners, and early adopters.

The growth within the largest whale category is widely believed to reflect the entry of institutions like MicroStrategy and BlackRock, which are known to custody their Bitcoin across hundreds of wallets (each 500+ different wallets). However, contrary to popular belief, the current sell-off is not being driven by the OG, legacy holders. The new whales are driving it, Wall Street participants, particularly ETF investors, who are now liquidating positions regardless of price. This is no IPO moment, this is the forced unwinding of a trade that has gone wrong, with risk managers stepping in to shut it down. But how much do those investors have left to sell? Let’s go through some numbers below and let’s define how low Bitcoin could fall.