What $84 Billion in DeFi Really Reveals About Ethereum’s Next Move

Actionable Market Insights

Why this report matters

Ethereum just experienced a breakout month, but the real story may be just beginning. While media headlines focus on ETFs and speculation, the quiet rise in DeFi activity and internal smart contract calls reveals a deeper shift underway. Institutional positioning is rising, as treasury firms replicate the MicroStrategy playbook, and a staggering $3 billion has flowed into Ethereum ETFs in just weeks.

Meanwhile, Asia is driving most of the repricing, and Ethereum’s share of the crypto market is surging. With the GENIUS Act implementation looming and on-chain metrics flashing bullish, this could be a structural turning point. What’s powering this move—and is it sustainable?

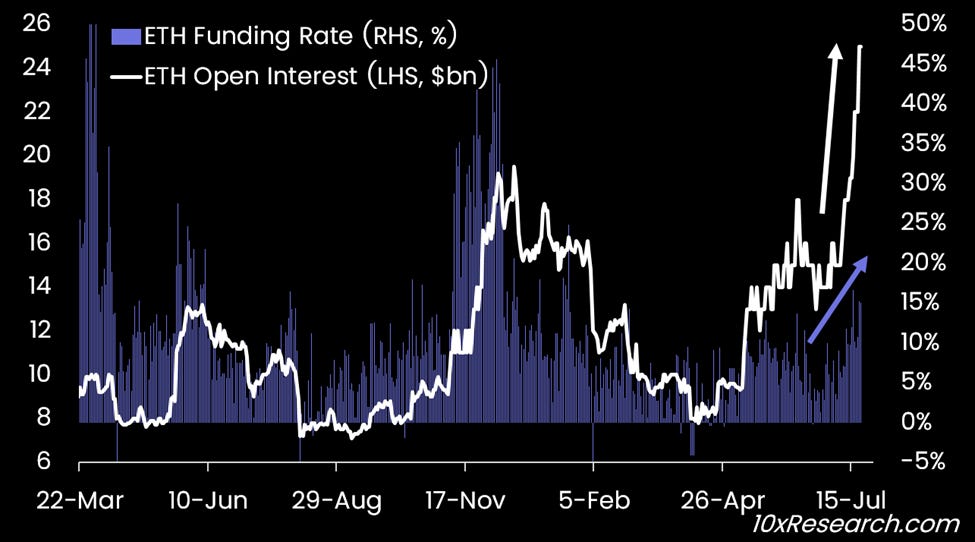

Ethereum Open Interest (LHS, $ billions) vs. ETH Funding Rate (RHS, %)

Main argument

Our bullish July call on Bitcoin was out of consensus, and it played out. In our July 9 Trading Strategy report (here), we flagged Ethereum’s setup: “increasing probability of a breakout, with bullish reversal indicators suggesting an imminent move. A break above $2,635 would confirm a bullish descending broadening wedge.” At the time, ETH was trading at $2,606. Simultaneously, our Trading Signals alert (here) highlighted “two notably bullish breakouts: Ethereum and Ripple”, trading at $2,603 and $2.30, respectively, now at $3,724 and $3.44. With gas fees remaining low, Ethereum’s rally unfolded as a classic technical breakout.

Although Bitcoin’s market capitalization is nearly five times larger than Ethereum’s, Ethereum has seen a more aggressive buildup in speculative positioning. Over the past three weeks, Ethereum’s open interest surged by $11 billion—up 79%—compared to Bitcoin’s $6.7 billion increase. During this period, Ethereum’s funding rate spiked from 5% to 15% as leveraged futures positions accumulated, with open interest rising from $8 billion in mid-April to $25 billion. Despite Ethereum’s sharp rally, funding rates remain relatively subdued, indicating that the surge is being fueled in part by spot buying rather than driven solely by leveraged speculation. Below we explain what this means for Ethereum’s next move.