What If Bitcoin Traders Are on the Wrong Side This Week?

Actionable Market Insights

Why this report matters

Derivatives traders remain decidedly bearish, even as analysts continue to tout their lofty year-end price targets. Bitcoin’s strongest quarter is historically just around the corner, yet this year feels different. The labor market is faltering, Powell is holding back, and traders are quietly shifting their strategies. Mega Whales are offloading coins while institutional Whales are absorbing supply—but only up to a point.

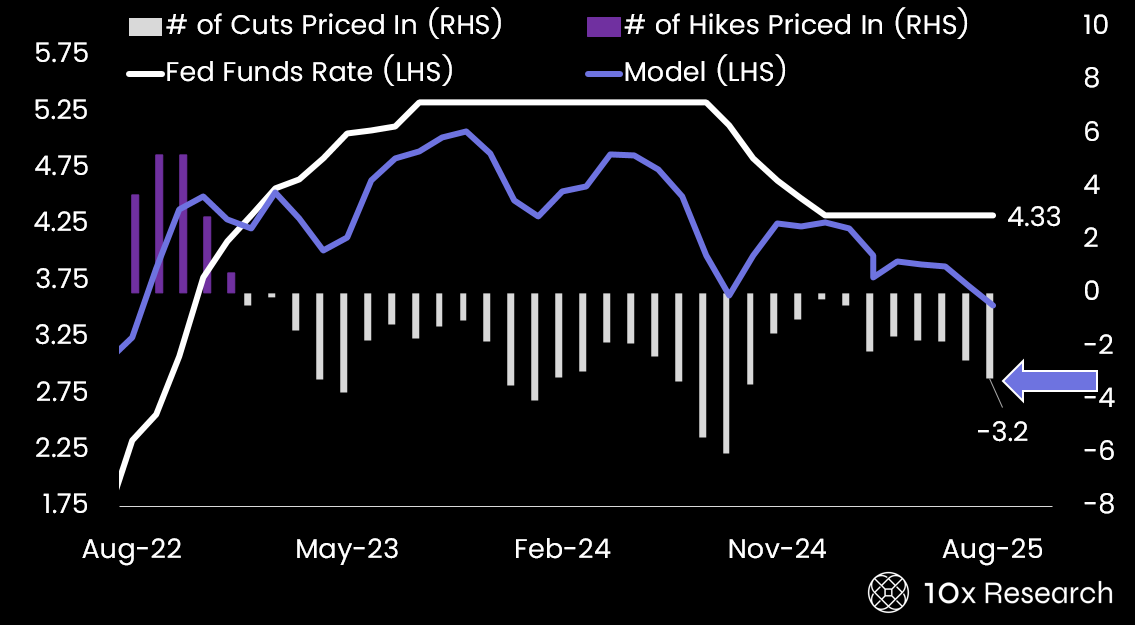

Rate cuts are coming, but are they a lifeline for growth or a warning sign of deeper trouble? Gold is breaking out, U.S. debt is surging, and volatility remains surprisingly cheap. It’s too early to focus on Q4 when September is loaded with event risk—but risk also creates opportunity. Traders need to navigate carefully, seeking out the proper risk/reward setups in this environment. Are these bearish Bitcoin option traders correctly positioned—or about to be caught on the wrong side this week?

Fed Funds Rate (LHS) - Number of Interest Rate Cuts Priced In (RHS)