When Bitcoin Volatility Falls but Polymarket Doesn’t: Harvesting the $100K Touch Mispricing

Actionable Market Insights

Why this report matters

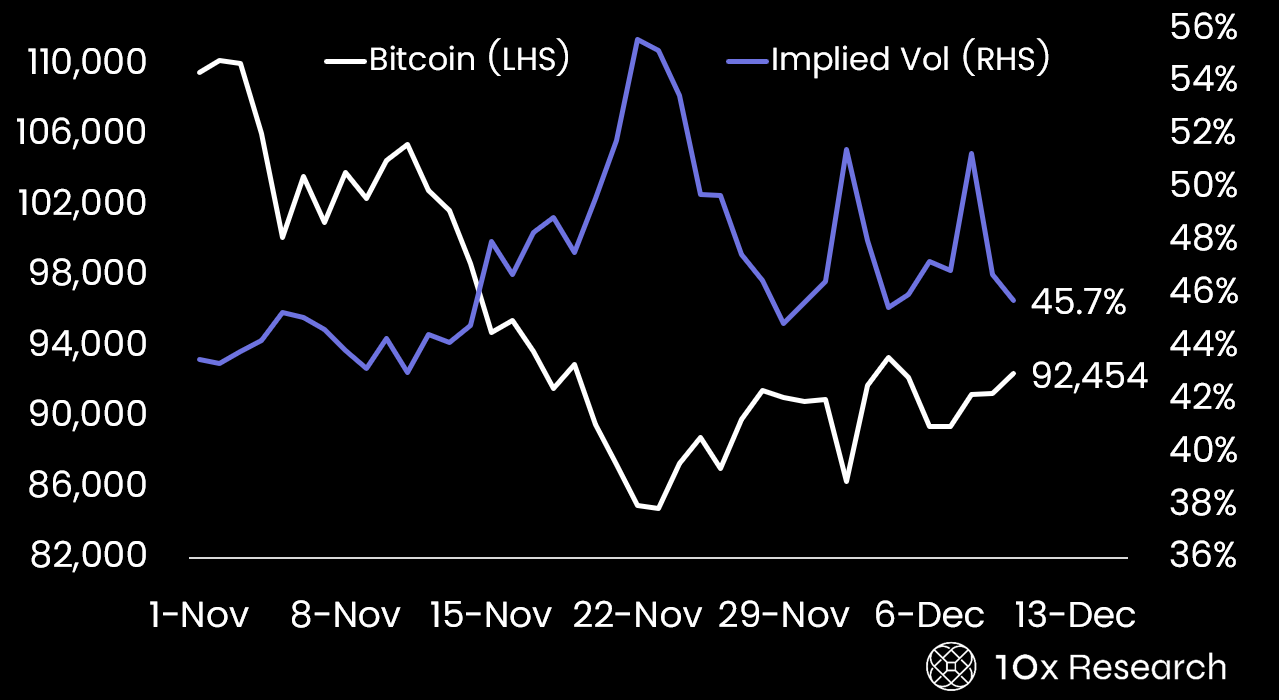

Below, we outline why Bitcoin volatility may now be mispriced on Polymarket following the latest rally attempt. With tonight’s FOMC decision serving as the final major catalyst of the year, implied volatility has already begun to roll over. Once the event risk clears, the probability should normalize quickly. The divergence likely reflects retail traders overpaying for the upside narrative while institutional markets on Deribit and IBIT continue to price a far more measured path. As a result, an actionable spread has emerged in the last twelve hours, one that is unlikely to remain open once post-FOMC repricing accelerates. Let us explain:

Bitcoin (LHS) vs. Implied BTC Volatility (RHS)