Why Bitcoin Traders Are Quietly Rotating From Puts to Calls

Actionable Market Insights

Why this report matters:

Bitcoin just saw a $13 billion drop in options value—a 33% plunge in days that few are talking about. Volatility is quietly collapsing. Traders are shifting strategies, but not in the way you might expect. Behind the scenes, institutional flows, macro signals, and positioning shifts are setting the stage for a potentially defining move. The question now isn’t just where Bitcoin is going, but what the market is pricing in.

A $13 billion drop in Bitcoin option open interest - what are the implications?

Main argument

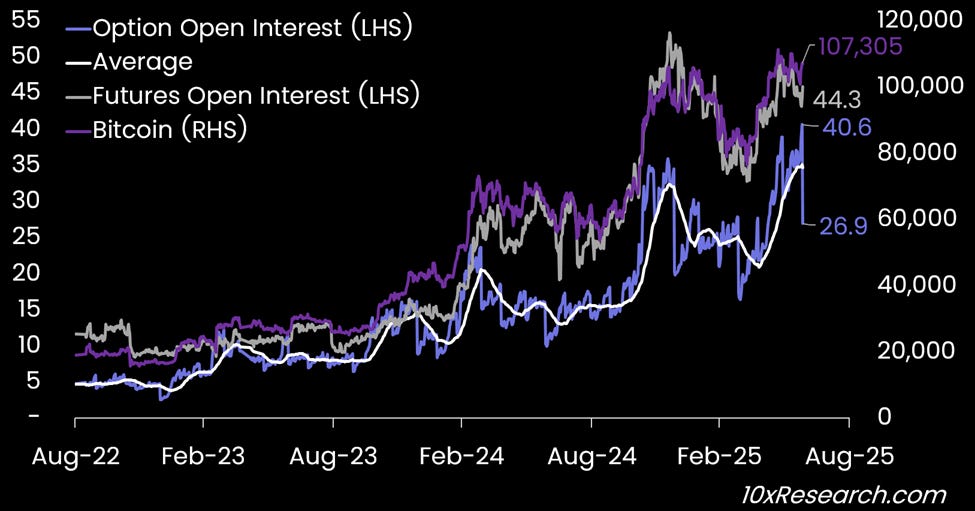

The notional value of Bitcoin options has just dropped by $13 billion, a 33% decline from just a few days ago—an abrupt shift that could carry significant implications for Bitcoin's near-term outlook. Since late 2024, Bitcoin derivatives—both futures and options—have become a dominant force, growing from a $10 billion market in 2022 to over $40 billion as of 2025. This surge has been accompanied by $47 billion in Bitcoin ETF inflows and $42 billion in purchases by MicroStrategy, signaling a broad institutionalization of the Bitcoin ecosystem across multiple fronts.