Why Is Ethereum Quietly Crashing? NEXT support?

Actionable Market Insights

Why this report matters

Over the past few weeks, crypto’s derivatives markets have begun flashing signals that don’t align with the price action. Funding, open interest and flows across BTC, ETH and SOL are moving in ways that have historically preceded significant shifts — but most traders aren’t watching them.

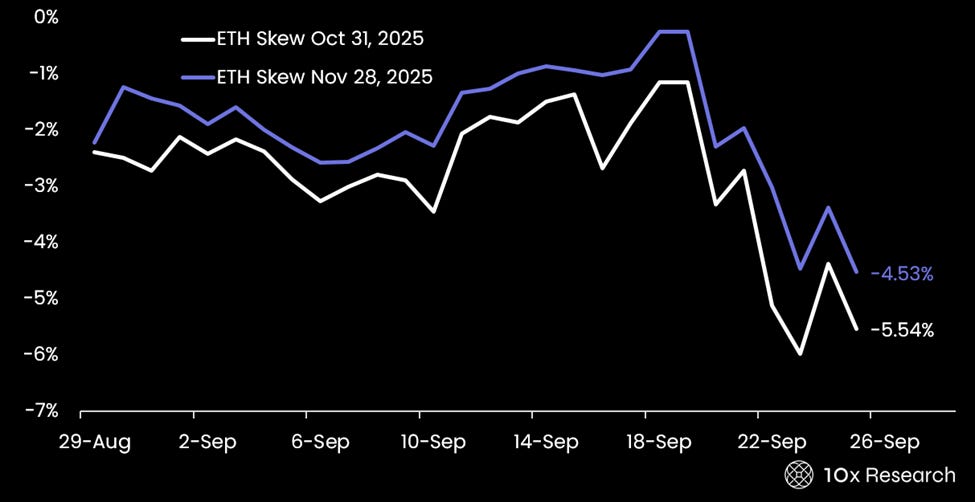

Hidden beneath the headline prices, skew and volatility curves are revealing where the real risk and opportunity may lie. At the same time, once-reliable narratives, such as the “digital asset treasury” theme, are losing momentum, changing who actually drives crypto flows. Key technical and on-chain levels are converging with unusual derivatives positioning, a combination that rarely lasts long.

Ethereum options skew

Main argument

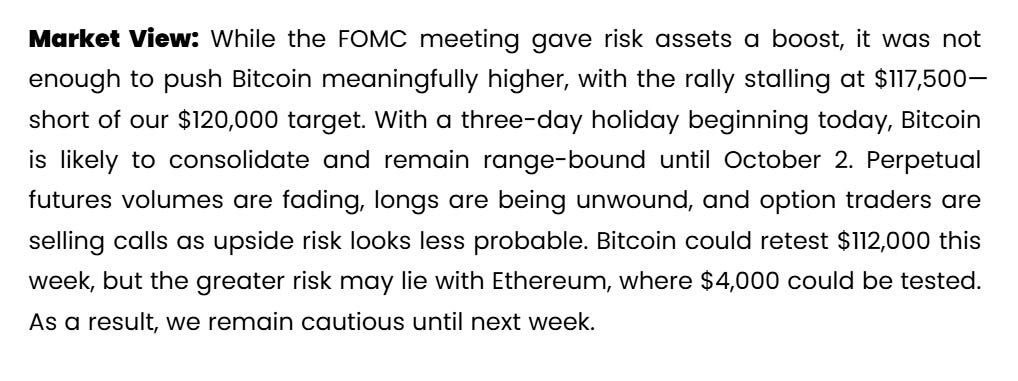

As highlighted in Sunday’s report, “Why High Leverage and Low Liquidity Could Be a Dangerous Mix,” and reiterated in Monday’s “10x Weekly Crypto Kickoff,” we warned that Ethereum could drop approximately 10% this week to $4,000 from $4,470, and that Bitcoin might slip below $112,000. Those moves are now materializing as over-leveraged positions are unwound. The bulk of the liquidations is occurring during Asian trading hours, driven by heavy participation from regional retail investors.

Below comment from Monday’s “10x Weekly Crypto Kickoff”