Why the CZ–YZi Labs Activism Is a Net Positive Catalyst for BNC’s Share Price

Actionable Market Insights

A few points to add:

CZ-backed YZi Labs is launching an aggressive consent campaign to reshape BNC’s board and force governance and strategy changes.

This consent battle is a net positive for BNC because the two most likely outcomes, an outright YZi victory or a negotiated settlement, both push the company toward stronger governance, better execution, and tighter alignment with BNB’s performance.

Either path introduces new oversight, improved disclosure, and potential management or fee-structure changes that the market typically rewards.

The only clearly bearish scenario is the least probable, and its downside is smaller than the upside embedded in the activism-driven scenarios. Net-net, the expected value for BNC’s share price is skewed significantly to the upside.

This is an activist boardroom coup attempt, not a classic cash takeover – but if YZi Labs/CZ win, they’ll effectively control BNC/CEA’s strategy and management.

BNB vs. BNC

YZi Labs (controlled by CZ) owns ~5% of CEA Industries / BNC. They’ve filed a Schedule 14A consent solicitation – essentially asking other shareholders, via written consent instead of a meeting, to: Restore the bylaws to their July 25, 2025 version (undo any defensive changes the board may have made), Increase the board size, Give shareholders, not the board, the exclusive right to fill those new seats, and Elect YZi’s own nominees into those new seats.

If YZi wins enough written consents (a majority of all outstanding shares, not just those who respond), then they could end up with a board majority, giving CZ/YZi de facto control of the company’s strategic direction without increasing their economic stake much beyond 5%.

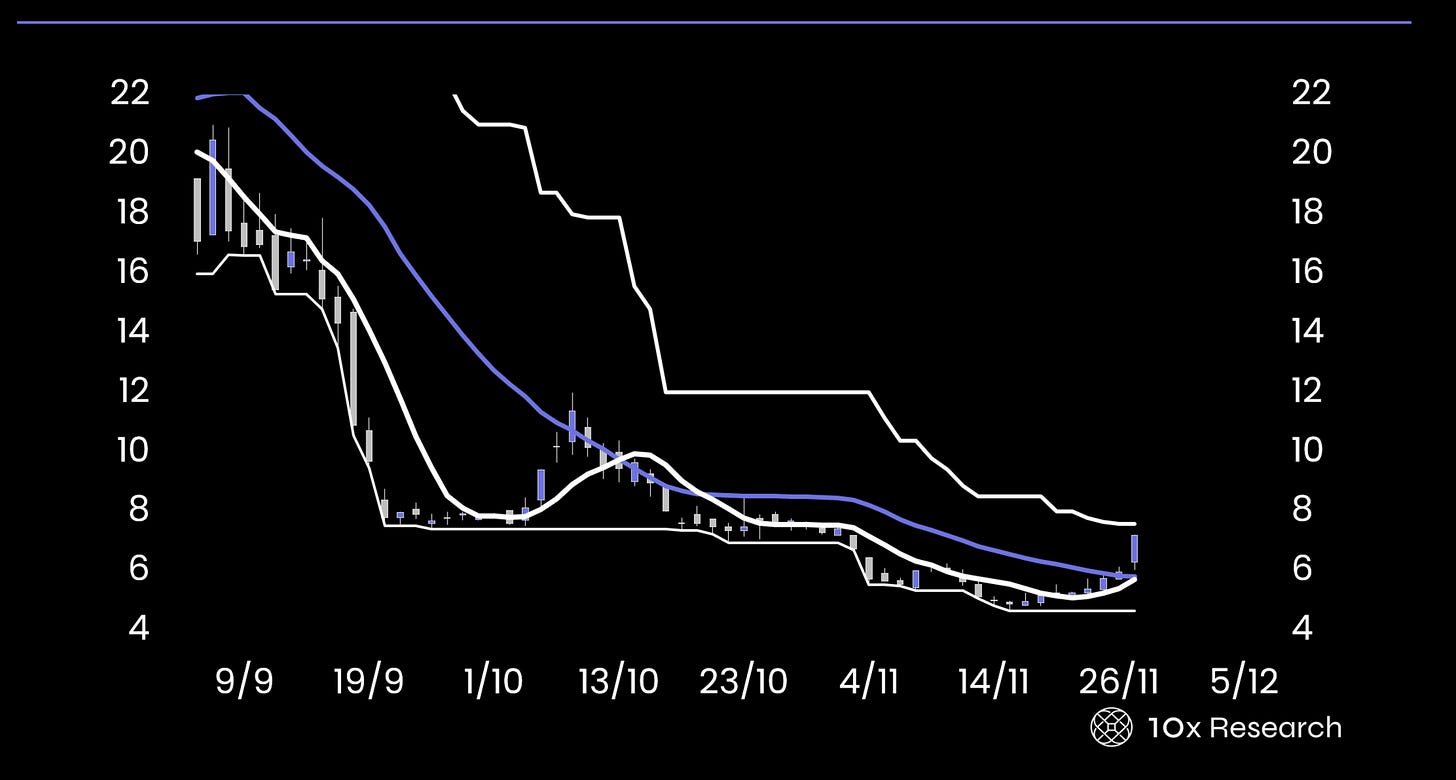

BNC massively underperformed BNB and other digital-asset treasuries since the PIPE and BNB treasury pivot. One article notes shares are down 92% from the post-PIPE high. Poor execution and delays (e.g., late ATM/shelf registration). Weak communication & IR – slow NAV updates, poor disclosure on BNB holdings & yield, underdeveloped investor-relations site. Lack of marketing/media presence given it’s a crypto-linked vehicle. Fee structure and conflicts around 10X Capital as asset manager and BNC’s current CEO (a senior partner at 10X (not affiliated with 10x Research).

A board-led review of the CEO and possibly a change of CEO (they say this almost explicitly in the “path forward” section). Potential renegotiation or reduction of 10X Capital’s fees, possibly shifting more influence to YZi or alternative management structures. A push to tighten governance, disclosure and close the NAV/BVN discount via better communication and capital-market strategy.

BNC share price

Potentially bullish factors: Activism usually signals at least one credible shareholder believes the company is undervalued relative to its assets/NAV. YZi’s thesis is explicitly: “BNB is doing well, BNC is not; fix execution & governance, close the gap.” IR, disclosure and marketing improve quickly. Board may review fees, capital allocation, and the CEO, which markets often interpret as positive governance reform. A perceived “CZ-backed” treasury vehicle could attract more speculative flow from BNB/crypto investors.

Bearish / risk factors: It’s about changing who runs the company, not paying a takeover price. If the fight gets ugly (dueling mailings, lawsuits, poison-pill style defenses, Nasdaq questions), it can Distract management from running the BNB treasury, Increase costs (legal, advisory, proxy solicitors), or Amplify headline and regulatory risk because of CZ’s history.

Scenario map for CEA/BNC:

Scenario A (probability 30%) – YZi wins outright (or near-outright): More aggressive BNB-aligned strategy and marketing push. CEA/BNC effectively becomes CZ/YZi’s flagship public BNB treasury vehicle. Share-price implication: Strongly bullish in the short term, volatile in the medium term.

Scenario B (probability 55%) – Negotiated settlement: Compromise on governance reforms, disclosure cadence, maybe some tweaks to fee structures. Less dramatic, but often healthier for valuation than a long proxy war. Share-price implication: Moderately bullish, most stable outcome.

Scenario C (probability 15%) – YZi fails to gain majority consents: Potential incremental governance moves from the company to appease shareholders, but less radical change. Share-price implication: Bearish to neutral.

Net-Net, this entire situation is positive for the BNC share price, because the weighted impact of the likely outcomes (Scenarios A and B) is meaningfully bullish compared to the single bearish outcome (Scenario C).

Please see last week’s report about BNC (here)