Why This Bitcoin vs. Coinbase Trade Just Paid Off—Again

Actionable Market Insights

Why this report matters

Coinbase just posted one of its weakest earnings surprises in recent quarters—yet the real story isn’t just about the miss. Behind the headlines, a subtle shift is underway that could reshape how investors value the stock going forward. At the same time, Bitcoin’s rally has created a divergence that some traders are quietly capitalizing on. With altcoin momentum fading and volumes compressing, the macro-crypto cycle may be entering a very different phase. Our regression models and valuation thresholds have flashed key signals—some already playing out, others just emerging. The question now is: has the tactical window for this high-conviction trade already closed, or is there still time to act?

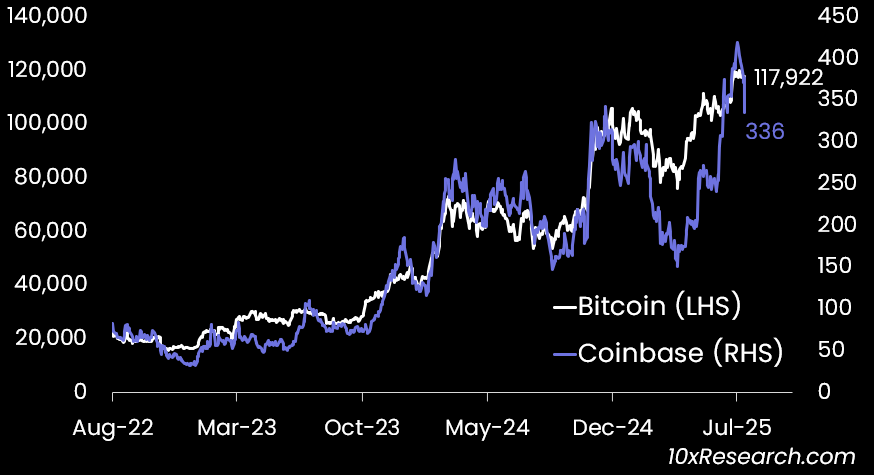

Bitcoin (LHS) vs. Coinbase (RHS) - Time to buy?

Main argument

In our May 12 report (here), we highlighted that Coinbase was trading well below levels implied by Bitcoin, and by June 27 (here), the stock had rallied 88%, prompting us to question: “Is Coinbase Running Too Hot After Its 88% Rally?” At that point, Coinbase traded “23% above our modelled fair value, approaching the 30% overvaluation threshold where a short position becomes increasingly compelling”.

Bitcoin was at $107,000, while Coinbase traded at $375 — a level we viewed as disconnected from both crypto trading volumes and spot BTC valuation. This divergence supported our long Bitcoin vs. short Coinbase call. As Bitcoin advanced to $117,000 by July 22 (see report here) and Coinbase gained another 10% (to $413), we reiterated our caution, noting that Coinbase now traded at a stretched valuation, reflecting peak bullish sentiment and a significant premium relative to BTC.

Since the earnings release, Coinbase shares have declined to $336 (–11%), while Bitcoin has risen 7.5%, resulting in an 18.5% relative outperformance for the long BTC vs. short COIN trade over the past five weeks. However, with our fair value estimate now back to neutral, the stock is no longer expensive—but it isn’t cheap either.