Wall Street’s $20 billion Crypto Funeral: Is This the Final Floor?

Actionable Market Insights

Why this report matters

With Wall Street investors facing a combined $20 billion drawdown across Bitcoin ETFs and Ethereum-treasury firm Bitmine, the institutional ‘long-only’ thesis is being put to the test. These staggering figures are forcing a fundamental rethink of how professional capital approaches the space, shifting the focus from passive ETF exposure to more sophisticated, active risk-management strategies.

In our latest report, we break down the “mechanical” nature of the recent capitulation event. While many retail traders were caught off guard, the data tells a deeper story of institutional distribution and a “liquidity vacuum” that was months in the making. And why the absence of a “Central Bank backstop” makes current realized losses a different beast entirely.

Main argument

In our November 21, 2025, report, “Wall Street Investors Wiped Out,” we identified a critical shift: institutional investors had entered a forced liquidation phase.

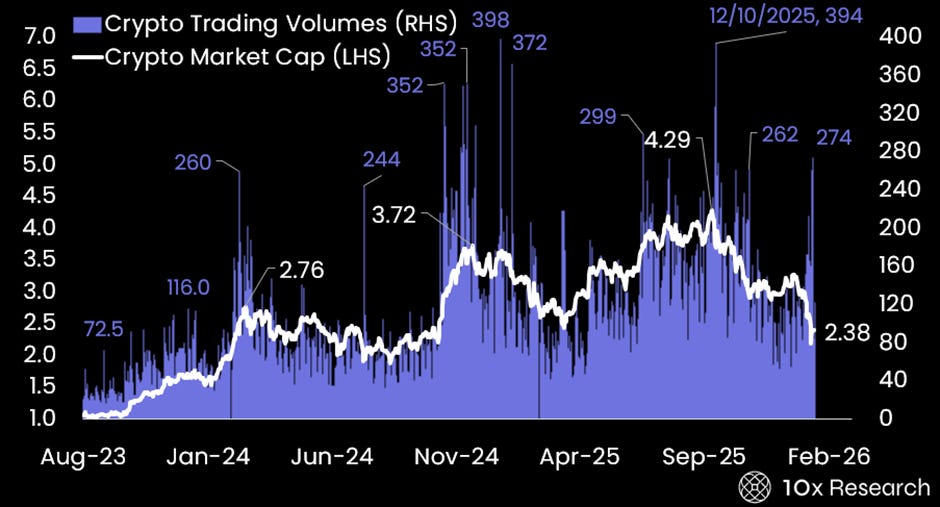

Crypto Market Cap (LHS, $ trillion) vs. Crypto Trading Volume (RHS, $ billion)