When the Crowd Loses, the Market Wins: Why Prediction Markets Reward the Few, Not the Many (Part 2 of 3)

Actionable Market Insights

Part 1 (here): Prediction markets have entered a structural inflection point: liquidity is rising, regulatory clarity has arrived, and retail participation is accelerating just as professional desks position themselves to capture spread and information asymmetry. This Part 1 lays the groundwork, market architecture, liquidity composition, regulatory unlock, and the historical analogs that proved, repeatedly, that when new venues open, informed traders don’t chase narratives; they monetize them.

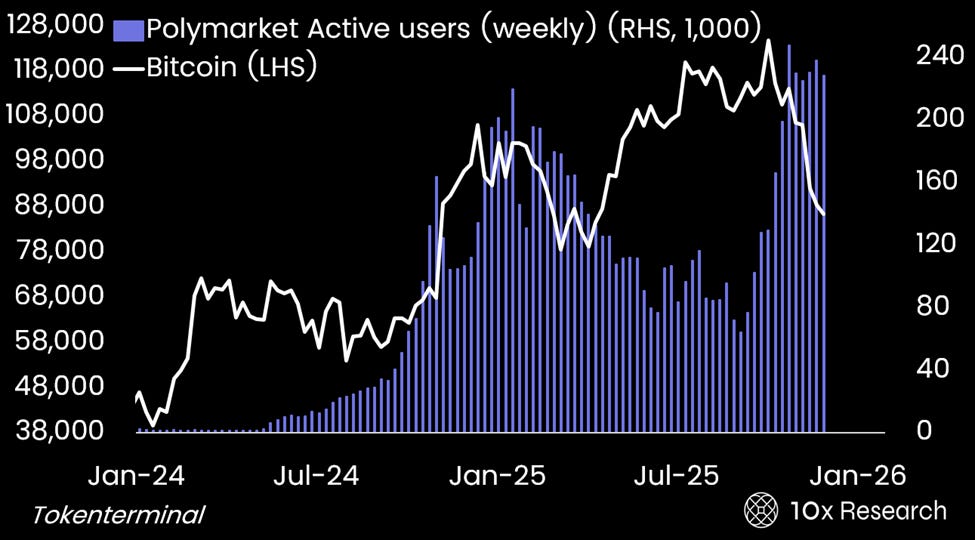

Bitcoin (LHS) vs. Polymarket active weekly users (RHS, x1,000)

Part 2: Prediction markets present themselves as collective intelligence machines, but the data show something far starker: accuracy and profit are driven not by the crowd, but by a tiny, informed elite who price probability, hedge exposure, and extract premium from retail-driven longshots. The majority of users behave like sports bettors—trading dopamine and narrative for discipline and edge—while a small cohort systematically monetizes mispriced optimism, order-flow imbalance, and late-stage convergence.

Part 3 will lay out our ten executable trading frameworks for prediction markets, distill them into ten practical “golden rules,” and walk through three live trade setups, two of which we believe are strong enough to justify execution for experience and potential edge development. Naturally, we’ll end up breaking one of our own ten golden rules, but some opportunities are simply too instructive (and too tempting) to ignore.

With prediction markets poised to expand significantly in 2026, this felt like the right moment to take a closer look, before liquidity deepens and the easy edges disappear.

Please read below Part 2 of our three-part series below and you can read Part 1 (here).